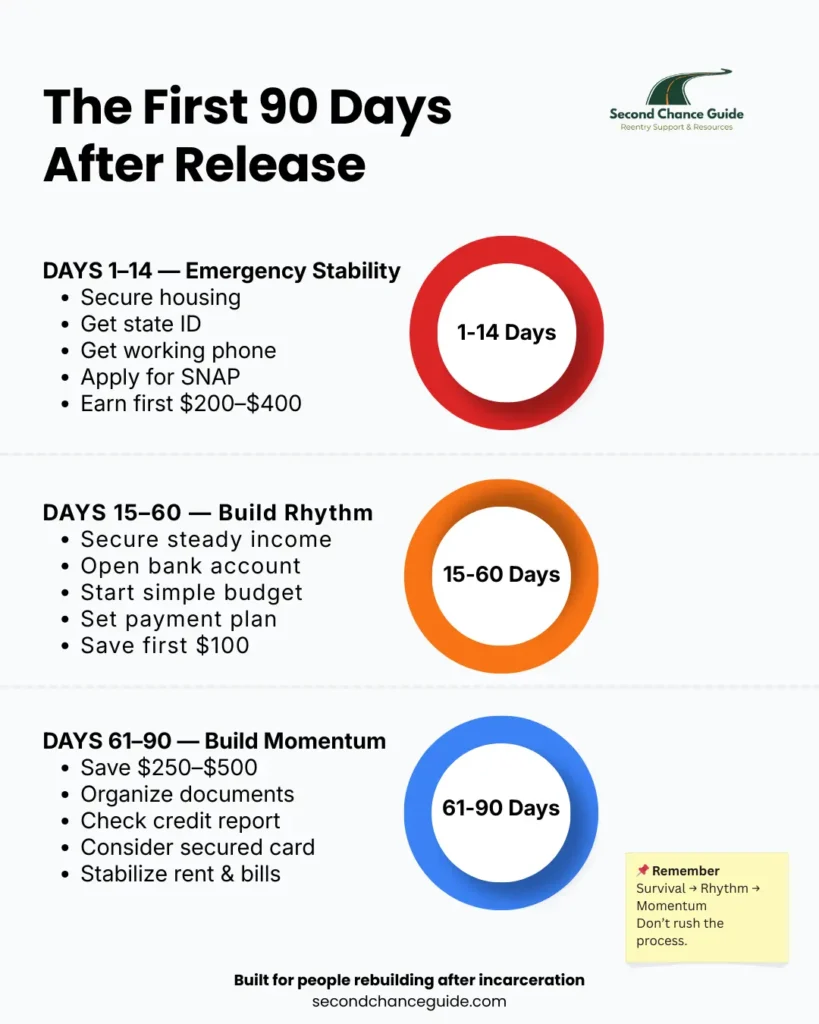

The First 90 Days: Tactical Timeline

Weeks 1-2: Emergency Stability

Day 1-7:

- Protect your gate money ($50-$200)

- Secure housing (halfway house, family, transitional program)

- Apply for SNAP benefits

- Get state ID ($10-$35)

- Obtain working phone (prepaid $30-$60 or Lifeline free phone)

Day 8-14:

- Find first income source (day labor, temp work, gigs)

- Save every pay stub and receipt—you’re building a paper trail

- Target: $200-$400 earned by Week 2

Benchmark: ID obtained, phone active, SNAP applied, housing secured, $100-$300 saved.

Weeks 3-8: Establishing Rhythm

- Secure consistent income ($800-$1,500/month minimum)

- Open bank account (see Second-Chance Banking below)

- Set up LFO payment plans with probation/court

- Start basic budget (track every dollar)

- Build $100 emergency fund

- Get proof of residence (utility bill, lease, letter from housing)

Benchmark: $800+/month income, bank account open, first LFO payment made, $100 saved.

Weeks 9-12: Building Paper Trail

- Compile “paper identity” folder: ID, Social Security card, pay stubs, utility bills, bank statements

- Check credit report at AnnualCreditReport.com

- Increase emergency fund to $250-$500

- Consider secured credit card if earning $1,200+/month consistently

Benchmark: $250-$500 saved, paper trail established, stable budget working.

LFO Management: Legal Financial Obligations Without Losing Your Housing

The hard truth: Courts, probation, and child support enforcement don’t care if you’re broke. Miss payments and you risk violation, re-incarceration, or wage garnishment.

Rule: Survival first, then compliance.

What Are LFOs?

- Court fines and fees

- Restitution to victims

- Supervision fees (probation/parole)

- Child support arrears

- Court-ordered drug testing fees

Average LFO debt at release: $5,000-$15,000 depending on state and charges. Some people owe $50,000+.

The Priority System

| Obligation | Priority | Why |

|---|---|---|

| Rent/Housing | 1 | Homelessness destroys everything else |

| Food | 2 | You can’t work if you’re starving |

| Utilities (if separate from rent) | 3 | Heat, water, electricity = basic survival |

| Phone | 4 | Required for job calls, PO check-ins |

| Supervision fees (probation/parole) | 5 | Non-payment can violate you back to prison |

| Court-ordered restitution | 6 | Violations possible, but often lower priority than supervision fees |

| Child support (current) | 7 | Wage garnishment likely, but they can’t jail you for inability to pay in most states |

| Court fines (non-restitution) | 8 | Last priority—negotiate payment plans |

If you cannot pay everything:

- Pay rent and food first. Always. Homelessness is harder to recover from than a probation violation.

- Call your probation officer immediately. Explain your income. Ask for reduced payment plan. Most POs would rather have $10/month than violate you back to prison (costs the state $30K-$60K/year to house you).

- Request a financial review hearing. Courts can reduce fines or restitution based on inability to pay. Bring proof: pay stubs, rejection letters from jobs, bank statements showing near-zero balance.

- Know your rights: In Bearden v. Georgia (1983), the Supreme Court ruled you cannot be jailed for inability to pay fines if you’re genuinely indigent. If threatened with jail for non-payment, request a court-appointed attorney.

Sample LFO Negotiation Script

“I was released on [date] and am currently earning $900/month working at [job]. My rent is $450, food is $200, and utilities are $80. That leaves me $170 for all other expenses. I want to comply with my restitution, but I cannot afford the current $150/month payment. Can we reduce this to $25/month while I’m getting stable, and I’ll increase it when my income improves?”

Most courts will work with you if you:

- Show up to hearings

- Bring documentation

- Demonstrate good faith effort

- Stay out of new trouble

Second-Chance Banking: How to Open an Account with Bad History

The problem: If you’ve had a bank account closed for overdrafts, unpaid fees, or fraud, you’re likely in ChexSystems—the banking industry’s blacklist. This blocks you from opening accounts at most major banks.

ChexSystems keeps records for 5 years. If you closed an account with -$500 balance in 2021, it’s flagged until 2026.

How to Check Your ChexSystems Report

- Visit ChexSystems.com

- Request free report (you’re entitled to one per year)

- Review what’s on file

Common reasons for ChexSystems flags:

- Unpaid overdraft fees

- Fraudulent activity (even if you were a victim)

- Too many accounts opened/closed in short period

- Bounced checks

Second-Chance Bank Accounts (No ChexSystems Check)

These banks specialize in people with bad banking history:

| Bank/Credit Union | Monthly Fee | Features |

|---|---|---|

| Chime | $0 | No ChexSystems check, mobile banking, early direct deposit |

| Varo | $0 | No ChexSystems, high-yield savings if you qualify |

| Current | $0 | No ChexSystems, instant gas hold refunds |

| LendingClub | $0 (with $250+ direct deposit) | No ChexSystems, decent overdraft protection |

| Local credit unions | Varies ($5-$10) | Many offer “fresh start” accounts, ask about second-chance programs |

How to open:

- Apply online (Chime, Varo, Current) or visit local credit union

- Provide ID and Social Security number

- Make small initial deposit ($10-$50)

- Set up direct deposit if employed

Why you need a bank account:

- Avoid check-cashing fees: Check cashing stores charge 1-5% per check. On a $800 paycheck, that’s $8-$40 lost every two weeks.

- Direct deposit = faster pay: Many jobs pay 1-2 days earlier with direct deposit.

- Build financial identity: Bank statements prove income for housing, loans, and credit applications.

- Safety: Cash gets lost, stolen, or spent impulsively. Bank accounts protect your money.

If denied everywhere: Open a prepaid debit card (not ideal, but better than cash). NetSpend, Bluebird (American Express), or PayPal debit cards function like bank accounts without ChexSystems checks. Fees are higher, but you can transition to real bank once you’re stable.

The “Paper Identity” Strategy: Building Documentation for Future Loans and Housing

The problem: You have no recent proof you exist financially. No utility bills in your name. No lease. No pay stubs. No credit history.

Landlords, lenders, and employers want to see a “paper trail” proving you’re stable and reliable.

The Essential Documents

Tier 1 (Immediate Needs):

- State-issued ID or driver’s license

- Social Security card

- Birth certificate (if you don’t have it, order from VitalChek.com for $20-$50)

Tier 2 (Proof of Residence):

- Utility bill in your name (electric, gas, water, internet)

- Lease agreement or letter from landlord

- Bank statement with your address

If you’re living with family/friends and can’t get utilities in your name: Ask to be added to one utility account, or get a letter from the primary resident confirming you live there (notarize it for $5-$10 at UPS Store or bank).

Tier 3 (Proof of Income):

- Pay stubs (keep every one for at least 6 months)

- Bank statements showing deposits

- 1099 forms if self-employed or doing gig work

- Tax returns (file even if you make under reporting threshold—it’s proof of income)

Tier 4 (Building Credit):

- Secured credit card (requires deposit, reports to credit bureaus)

- Credit-builder loan (Self.inc, Credit Karma offer these—you “borrow” money that’s held in savings, then paid back over 12-24 months, building credit history)

- Authorized user on someone else’s card (if you have family/friend with good credit who trusts you, ask to be added—their history helps your score)

Why This Matters

Landlords: Most want to see 3 months of pay stubs and proof of address. Without this, you’re stuck in week-to-week motels or sublets.

Lenders: Credit cards, car loans, and personal loans require proof of income and address. Even terrible credit (500 score) can get approved if you have documentation.

Jobs: Some employers verify address and previous employment. If you can’t provide this, you look unreliable.

Government benefits: Housing vouchers (Section 8), TANF, disability—all require extensive documentation.

Start building your paper trail in Week 1. Every piece of mail, every pay stub, every utility bill—keep it organized in a folder or binder.

Budgeting for Inconsistent Income

Survival Budget ($800-$1,200/month)

| Expense | Amount |

|---|---|

| Rent/Housing | $400-$600 |

| Food (SNAP + cash) | $150-$250 |

| Utilities | $40-$80 |

| Phone | $30-$50 |

| Transportation | $60-$100 |

| Supervision fees | $25-$50 |

| Laundry/hygiene | $20-$40 |

| Miscellaneous | $30-$50 |

| TOTAL | $755-$1,220 |

Key principle: At this income, you cannot save aggressively. Focus on not going backwards. Any extra $20-$50/month goes into emergency fund.

Growth Budget ($1,500-$2,500/month)

| Expense | Amount |

|---|---|

| Rent/Housing | $500-$800 |

| Food | $200-$300 |

| Utilities | $60-$100 |

| Phone | $40-$60 |

| Transportation | $80-$150 |

| LFO payments | $100-$200 |

| Emergency fund | $100-$200 |

| Debt repayment | $50-$100 |

| Personal/misc | $80-$120 |

| TOTAL | $1,210-$2,030 |

The buffer: Extra $300-$500/month can accelerate emergency fund to $2,000-$3,000, pay down high-interest debt, or save for car/housing.

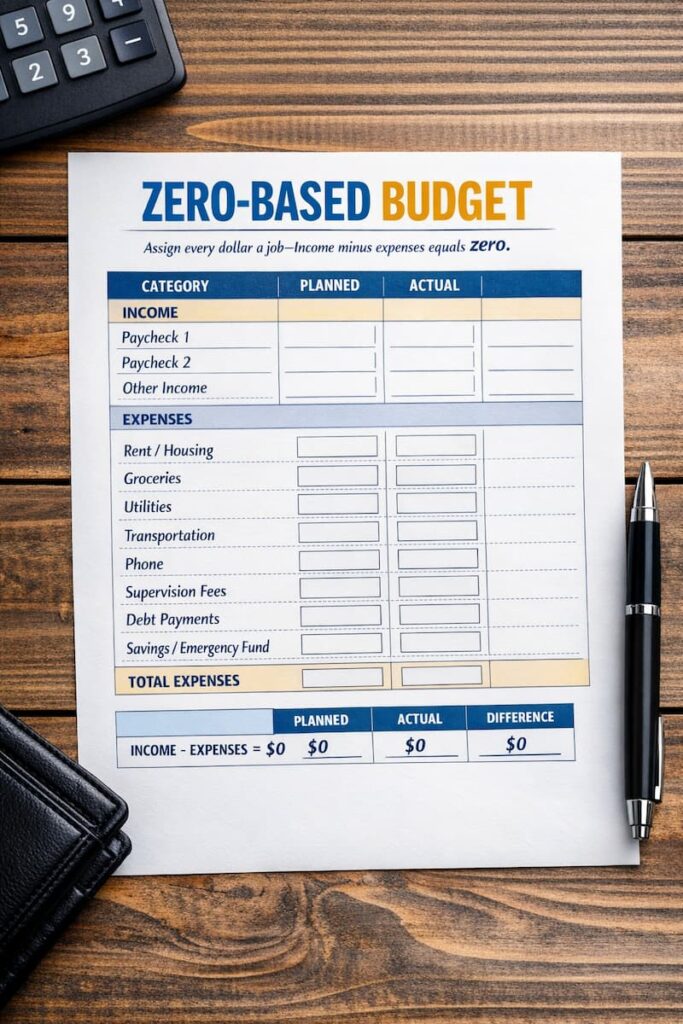

Zero-Based Budget for Fluctuating Income

- Calculate bare minimum expenses (example: $750/month)

- On payday, allocate every dollar immediately

- If you earn $900, the extra $150 gets assigned: $100 emergency fund, $50 extra LFO payment

- Don’t spend unallocated money

- Re-budget every time money comes in

Example: Earn $1,200 one month, $800 the next. Month 1: Save $250 + extra payments. Month 2: Cover essentials only. Average $1,000/month but still saved $250 total.

Debt Prioritization: What to Pay, What to Ignore (For Now)

The reality: You likely have thousands in old debt. Credit cards, medical bills, court fines, restitution, child support arrears. You cannot pay it all.

Debt Tiers: What to Tackle First

Tier 1 – Immediate Threats (Pay These):

- Child support (current, not arrears): Ongoing obligation. Failure to pay current support can result in wage garnishment, license suspension, or contempt of court.

- Supervision fees: Non-payment can violate probation/parole.

- Court-ordered restitution: Lower priority than supervision fees, but still monitored.

Why these first: They have enforcement mechanisms that can re-incarcerate you or destroy your ability to work (license suspension).

Tier 2 – Government Debt (Address When Stable):

- Federal student loans: Can garnish wages and tax refunds. Contact loan servicer for income-driven repayment ($0/month if income is low enough).

- IRS debt: Tax liens can seize assets. Set up payment plan at IRS.gov (as low as $25/month).

- State taxes: Similar to IRS but handled at state level.

Why second: Government debt doesn’t go away and has serious long-term consequences, but rarely results in immediate jail time if you’re in communication and making token payments.

Tier 3 – Survival Debt (Ignore While in Survival Mode):

- Old credit card debt: If it’s been charged off (180+ days delinquent), it’s with a collection agency. They can sue, but rarely do for debts under $2,000. They cannot garnish wages without court judgment.

- Medical bills: Rarely sue. If they do, judgments are often uncollectible if you’re low-income.

- Payday loans: Illegal in many states to jail for non-payment. If sued, show up to court and request payment plan based on income.

Why last: These debts hurt your credit score but cannot send you back to prison or garnish wages without extensive legal process.

What About Child Support Arrears?

The brutal truth: Most states suspend driver’s licenses, professional licenses, and passports for child support arrears over $2,500. Some states jail for contempt (though this is rarer post-Turner v. Rogers 2011 Supreme Court ruling).

Strategy:

- Pay current support first. If ordered to pay $300/month, pay that before touching arrears.

- Request modification hearing. If your income is significantly lower than when the order was set, courts can reduce your obligation. Bring pay stubs.

- Negotiate arrears payment plan. Even $25/month on arrears shows good faith and keeps enforcement at bay.

- Know your state’s rules: Some states offer “arrears forgiveness programs” if you stay current for 12-24 months.

Do NOT: Ignore child support entirely. This is one of the few debts that can result in jail time, and it compounds with 6-12% annual interest in most states.

The “Bootstrap” Emergency Fund: Saving Your First $100 When You Feel Too Broke to Save

The psychological block: “I’m living paycheck to paycheck. How can I save when I don’t even have enough to eat?”

The truth: You’re right—it’s nearly impossible. But $100 is the difference between handling a flat tire and losing your job because you can’t get to work.

The $100 Challenge (12 Weeks)

Week 1-4: Save $5/week = $20 total

- Skip one fast food meal

- Walk instead of Uber once

- Return bottles/cans for deposit

Week 5-8: Save $7/week = $28 total

- Sell something you don’t need (old phone, clothes, tools)

- Do one gig job and save half

Week 9-12: Save $10/week = $40 total

- Cut one subscription (Netflix, Spotify)

- Work one extra shift or side hustle hour

Total after 12 weeks: $88. You’re at $100 with two more $6 contributions.

Where to Keep It

Option 1: Separate savings account

- Open high-yield savings at Ally, Marcus, or Capital One 360

- Transfer $5-$10 automatically each payday

- Don’t link it to your checking—make it slightly annoying to access

Option 2: Cash envelope at home

- Hide it somewhere not obvious (not your wallet or nightstand)

- Don’t touch it unless it’s a genuine emergency

Option 3: Trusted friend/family member

- Ask someone responsible to hold $100 for you

- Only withdraw for emergencies with their approval

What Counts as an Emergency

Actual emergencies:

- Car breaks down and you need it for work

- Eviction notice and you’re $50 short on rent

- Medical issue that prevents you from working

- Phone breaks and you need it for job

Not emergencies:

- Concert tickets

- Eating out because you’re tired of cooking

- New shoes (unless your current ones have holes and you work on your feet)

- Holiday gifts

Rule: If it doesn’t threaten your housing, job, or health, it’s not an emergency.

Rebuilding Credit: The Long Game

Your credit score is likely 450-550. It can improve 100+ points in 12-24 months with consistent behavior.

Month 1-6:

- Check credit report at AnnualCreditReport.com, dispute errors

- Open secured credit card ($200-$500 deposit)

- Use for one recurring bill, pay off in full monthly

- Become authorized user on family member’s good credit card (if possible)

Month 7-12:

- Never miss a payment (35% of score)

- Keep utilization under 30% (if $300 limit, carry max $90 balance)

- Consider credit-builder loan (Self.inc, Credit Karma)

Month 13-24:

- Graduate to unsecured card

- Add second tradeline (small loan or financed car if needed)

- Keep old accounts open (length of history matters)

Realistic timeline:

- Year 1: 500 → 580-620

- Year 2: 620-660

- Year 3+: 680-720 with consistency

What kills your score: Missed payments, maxed-out cards, collections, too many hard inquiries. What helps: On-time payments, low utilization (under 10% ideal), mix of credit types, older accounts.

Financial Traps to Avoid

Payday/title loans: 300%+ APR. Better options: borrow from family, sell belongings, ask employer for paycheck advance, local nonprofit emergency aid.

Rent-to-own: Pay $1,200 for a $400 TV. Buy used on Craigslist/Facebook Marketplace instead.

Credit repair companies: Pay $500-$1,500 for services you can do free at AnnualCreditReport.com.

Ignoring court dates: Missing hearings = warrants. Always show up. Courts reduce fines if you bring pay stubs and proof of expenses.

When You’re Stable: Next Moves

Once you have 6+ months consistent income ($1,500+/month), $1,000-$2,000 emergency fund, LFOs current, and 600+ credit score:

- Upgrade housing – Get your own place or 1BR

- Buy reliable car (if needed) – Subprime loans exist at 10-18% APR

- Start business – Use our window cleaning, landscaping, or side hustle guides

- Skills training – Welding, HVAC, CDL ($20-$35/hour jobs)

- Think homeownership – FHA loans accept 580+ credit with 3.5% down

Resources and Next Steps

Government assistance programs:

- SNAP (food stamps): Benefits.gov

- TANF (cash assistance): Contact your state’s Department of Social Services

- Medicaid: Healthcare.gov or your state’s Medicaid office

- Lifeline (free/reduced phone): LifelineSupport.org

Banking resources:

- Chime, Varo, Current: No ChexSystems second-chance banks

- Local credit unions: Search “second-chance banking [your city]”

Credit building:

- AnnualCreditReport.com: Free credit reports (once per year from each bureau)

- Self.inc: Credit-builder loans

- Secured credit cards: Discover It Secured, Capital One Secured

Legal and financial assistance:

- Legal Aid: LawHelp.org (free legal help for low-income individuals)

- SCORE: Score.org (free business mentoring)

- Local reentry programs: Visit our state-by-state directory for programs in your area

Debt and LFO help:

- National Consumer Law Center: NCLC.org (know your rights regarding debt collection)

- Child Support Services: Contact your state’s child support enforcement agency to request modification hearing

You’re not going to fix everything in 90 days. Financial recovery after incarceration takes 1-3 years for most people. But every month you stay out, stay employed, and stay compliant, you’re building a foundation that nobody can take away from you.

The goal isn’t wealth. It’s stability, options, and never being desperate enough to go back to what got you locked up in the first place.

Looking for income opportunities? Check our guides on starting a business after reentry, side hustles while employed, and second-chance employers hiring in 2026.

Need more reentry resources? Visit our state-by-state directory for housing assistance, job training, legal aid, and support services in your area.