Introduction

Reentering society after incarceration means rebuilding every part of your life — and one of the most important (and overlooked) steps is opening a bank account.

Without one, you’re stuck in cash-based traps: payday lenders, check-cashing fees, and prepaid cards that drain your money.

A legitimate checking or savings account is more than convenience — it’s financial proof that you’re back in control.

But many people face real barriers:

- Old accounts that were closed while they were inside

- Unpaid bank fees or ChexSystems reports

- No current ID or address

- Hesitant banks that don’t understand reentry situations

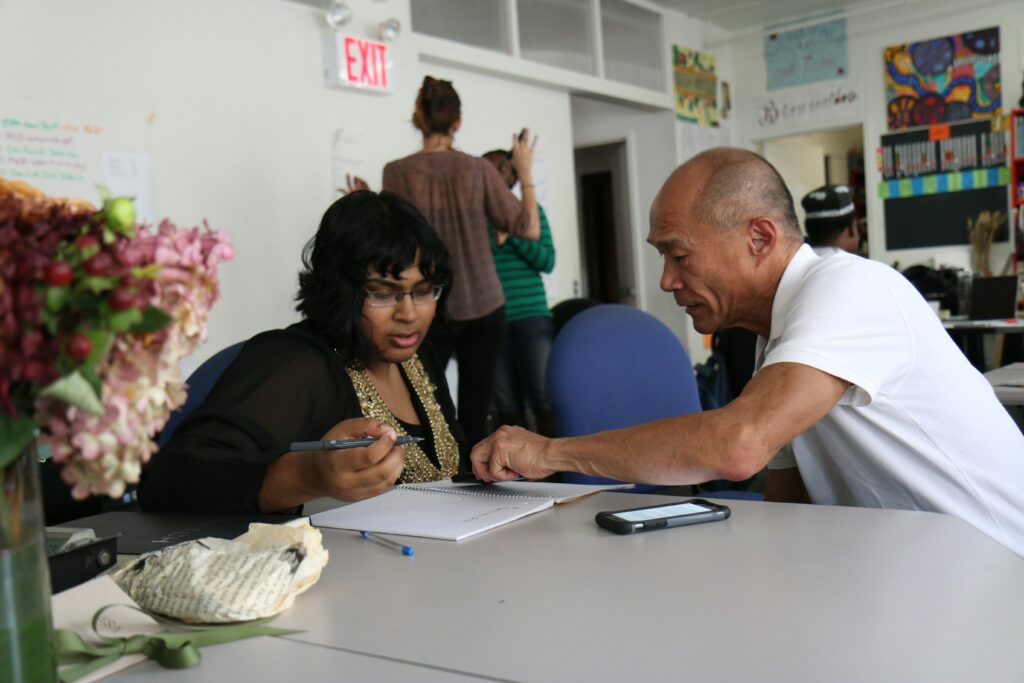

In recent years, more banks and credit unions have introduced second-chance banking programs… designed for exactly this problem. These banks and credit unions specialize in helping people restart safely — sometimes even without perfect ID or prior banking history.

This guide breaks down exactly how to open an account, what to bring, which banks to look for, and how to avoid getting rejected again.

💡 Remember: A checking account isn’t just about where your money sits — it’s the foundation for credit, direct deposit, and long-term financial stability.

Article Overview

You’ll learn:

- Steps 1–3: How to choose the right bank, gather required documents, and clear past account issues.

- Steps 4–6: How to open your account, set up direct deposit, and manage it safely.

- Common Issues: Rejections, ID gaps, or ChexSystems problems — and how to fix them.

- FAQ + Summary: Fast answers for successful reentry banking.

If you’re blocked right now, jump straight to Step 3 — that’s where most rejections are fixed.

Related resources:

- How to Rebuild Your Credit After Incarceration (2026 Guide)

- Best Second-Chance Employers Hiring in 2026

- How to Find Reentry Housing Near You

Step 1: Choose the Right Type of Bank or Credit Union

Not every bank is created equal — and not every one is friendly toward people with past financial issues or records.

Your first move is picking an institution that wants to work with reentry clients.

Options in 2025

- Second-Chance Checking Accounts: Offered by major banks like Wells Fargo, PNC, and Capital One. Designed for people with ChexSystems or prior closures.

🟢 Examples: “Opportunity Checking” (Wells Fargo), “Easy Checking” (U.S. Bank). - Credit Unions: Local credit unions are flexible with ID, fees, and history. Many partner with reentry or halfway programs.

- Online Banks: Digital banks like Chime, GO2Bank, and Current often skip traditional screening and let you open an account by smartphone.

Compare:

- Minimum deposit

- Monthly fees or waivers

- Whether they report to ChexSystems

💬 Pro tip: Start with one solid account at a reputable bank or credit union — not multiple apps you can’t track.

🖇 Internal Link: How to Rebuild Your Credit After Incarceration (2025 Guide)

Step 2: Gather the Required Documents Before You Apply

Most account rejections happen because of missing documents — not your record.

✅ Essential Documents

- Government-issued photo ID (driver’s license, state ID, passport, or release ID)

- Social Security number or ITIN

- Proof of address (utility bill, lease, shelter letter, or halfway-house documentation)

If no address:

Ask if the bank accepts mail from a reentry program, a shelter letter, or a parole office confirmation.

Optional but Helpful

- Pay stub or benefits letter (for direct deposit setup)

If you lack ID, check local DMV or reentry ID-restoration programs.

💡 Tip: Call ahead — second-chance programs are often flexible if you explain your situation.

🔗 External Resource: FDIC – Bank Account Basics and Requirements

Step 3: Clear Up Past Bank or ChexSystems Issues

Old overdrafts or unpaid fees reported to ChexSystems or Early Warning Services (EWS) are fixable.

Request your free ChexSystems report:

👉 www.chexsystems.com

Look for:

- Unpaid balances (< 5 years old)

- Fraud flags (investigate if wrong)

- Expired entries (> 5 years should drop off)

If debts are valid, call the bank and ask about “payment-for-removal.”

If errors appear, dispute online or by mail and keep copies.

Get a clearance letter once resolved — some banks will ask for proof. Even a paid balance without removal still improves approval odds.

⚙️ Pro tip: Keep every receipt and dispute email — that paper trail protects you later.

🖇 Internal Link: How to Rebuild Your Credit After Incarceration (2025 Guide)

Step 4: Open the Account — Online or In-Person

In-Person

Visit a branch, explain you’re rebuilding after release, and ask for their “second-chance” option.

Bring ID, proof of address, and small deposit ($25–$50).

Ask directly about ChexSystems and overdraft fees before signing.

Online

Use FDIC-insured banks like Chime, Varo, or GO2Bank. Upload photo ID and proof of address.

Avoid prepaid debit cards — they don’t build financial history.

💡 Tip: Start with a checking account that has no overdraft fees and no minimum balance. And never lie on an application — mismatched info causes automatic denials.

🖇 Internal Link: How to Rebuild Your Credit After Incarceration (2025 Guide)

Step 5: Set Up Direct Deposit and Track Every Dollar

Direct deposit proves reliability and builds positive history.

Use it for:

- Paychecks

- SSI/SSDI or veterans benefits

- Unemployment or child-support income

Ask your employer or agency for a direct-deposit form — activation takes one to two pay cycles. And avoid cash withdrawals when possible — consistent digital activity matters

Then use your bank’s app to:

- Check balances daily

- Enable low-balance alerts

- Track deposits and spending

💬 Pro tip: Keep at least a month of steady deposits before applying for credit — lenders value visible banking history.

🖇 Internal Link: Best Second-Chance Employers Hiring in 2025

Step 6: Manage Your Account Safely and Build Trust

Stay active and fee-free:

- Check balances regularly

- Use alerts for low funds

- Opt-out of overdraft protection

- Maintain activity every month, even small deposits.

- Never return to check-cashing stores

If your bank offers free budgeting or counseling, use it.

⚙️ Reminder: The goal is 12 months of clean, positive history — that alone rebuilds financial trust.

🔗 External Resource: FDIC – Safe Banking Tips for New Account Holders

Common Issues When Opening a Bank Account After Release

- Denied for ChexSystems or old debts → Ask for second-chance account; dispute or settle old reports.

- No address → Use shelter or parole-office letter.

- No ID → Apply for temporary ID; some credit unions accept release paperwork.

- Bank refuses due to record → Try credit unions or online banks.

- Overdrafts → Disable protection completely.

- “Not enough history” → Start with online bank, build six months of activity.

💡 Reminder: The first “no” doesn’t define you — persistence and preparation do.

FAQ: Opening a Bank Account After Incarceration

1. Can I open an account if I still owe a bank money?

Yes — many second-chance accounts approve balances under $500.

2. What if I don’t have ID or Social Security card?

Use temporary ID or release paperwork; credit unions often accept these with a reentry letter.

3. Can parole or reentry programs help?

Yes, many partner with community banks for safe account openings.

4. Should I open a joint account with family?

Not yet — build your own history first.

5. Are prepaid cards a good option?

Only temporarily; they don’t build history and charge high fees.

6. What if I overdraft by accident?

Call immediately — most banks waive the first fee if you communicate quickly.

7. Can I open an account while still incarcerated?

Short answer: Sometimes, through reentry programs — ask your counselor.

🖇 Internal Links:

- How to Rebuild Your Credit After Incarceration (2025 Guide)

- Best Second-Chance Employers Hiring in 2025

- How to Find Reentry Housing Near You

🔗 External Resource: CFPB – Safe Banking Basics

Summary: Start Small, Stay Consistent, Build Forward

Opening a bank account is more than a task — it’s your ticket back into the financial system.

Even after denials, 2026 options exist for true second chances.

Quick Recap

- Choose the right bank or credit union

- Gather ID and proof of address

- Clear old ChexSystems issues

- Open the account in-person or online

- Set up direct deposit

- Keep it active and fee-free

💬 If you’re stuck at any step, start with reentry programs in your state — many help with ID, banking, and employer coordination.

💬 Bottom line: Your bank account is your foundation for stability, credit, and long-term independence.